Student Upkeep Profile Accounting (SUPA)

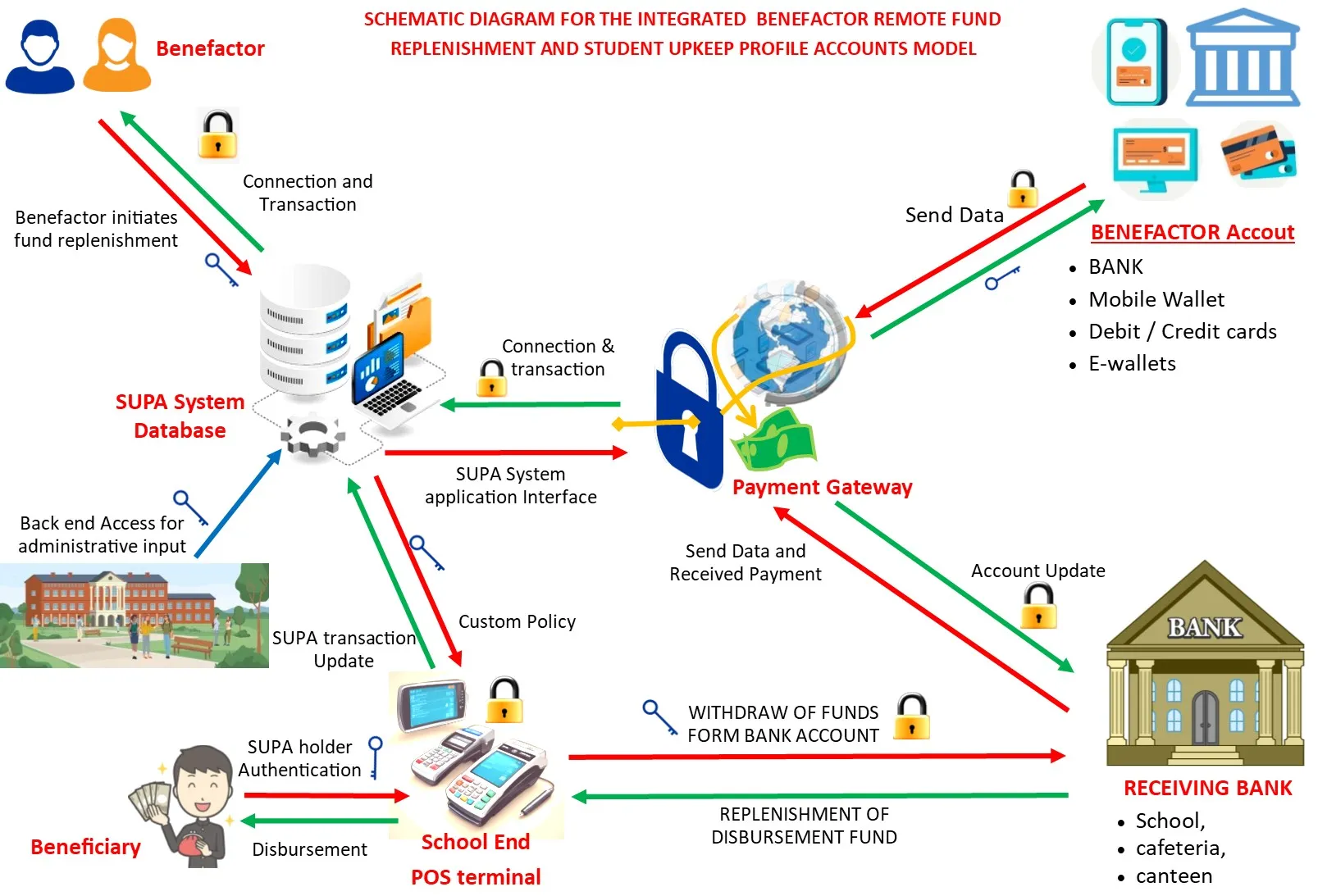

The SUPA System is an innovative digital platform that streamlines the management of student pocket money in boarding schools by integrating remote fund replenishment, secure disbursement via E-POS terminals, and comprehensive accounting tools. It enables benefactors, such as parents or guardians, to remotely top up students’ e-wallet accounts using digital money transfer systems, while providing students with controlled access to their funds through point-of-sale terminals.

What SUPA is

Student Upkeep Profile Accounting System with Point of Sale Integration

The SUPA System is an innovative digital platform that streamlines the management of student pocket money in boarding schools by integrating remote fund replenishment, secure disbursement via E-POS terminals, and comprehensive accounting tools. It enables benefactors, such as parents or guardians, to remotely top up students’ e-wallet accounts using digital money transfer systems, while providing students with controlled access to their funds through point-of-sale terminals. The system also offers real-time financial tracking and reporting for both schools and benefactors, promoting transparency, accountability, and financial literacy.

Background: Boarding schools often face challenges in managing and disbursing pocket money to students. Traditional methods relying on manual cash handling can be cumbersome, prone to errors, and lack transparency. Existing digital money transfer systems offer convenience but may not be tailored to the specific needs of boarding schools in managing student pocket money.

Summary: The Student Upkeep Profile Accounting (SUPA) System addresses these challenges by integrating a point of sale terminal with existing digital money transfer systems. This integration allows for remote benefactor replenishment of student pocket money across all financial platforms, seamless dispensing of pocket money to students while enabling the school to maintain control over the amounts disbursed. The system also maintains individual ledger accounts for each student, providing transparency and accountability.

Key features of the System:

- Integration with Digital Money Transfer Systems: The system interfaces with existing digital money transfer systems used by the school, allowing for the seamless transfer of funds to student accounts.

- Point of Sale Terminal: Each boarding school is equipped with a point of sale terminal stationed at a designated location, such as the school store or cafeteria.

- Student Identification: Students are provided with unique identification credentials, such as RFID cards or biometric authentication, linked to their individual accounts.

- Dispensing Pocket Money: When a student wishes to withdraw pocket money, they present their identification credentials at the point of sale terminal.

- Verification and Authorization: The system verifies the student’s identity and checks the available balance in their account. If the requested amount is within the predefined limits set by the school, the transaction is authorized.

- Ledger Management: Each transaction is recorded in the student’s ledger, detailing the amount dispensed, date, and purpose.

- Control Mechanisms: The school administration has access to a central control panel where they can set limits on the amount of pocket money dispensed to students, adjust limits as needed, and monitor transactions in real-time.

- Reporting and Analytics: The system generates comprehensive reports and analytics, providing insights into student spending patterns, account balances, and overall financial health.

Advantages:

- Efficiency: Automates the process of dispensing pocket money, reducing administrative burden and errors.

- Transparency: Provides transparency in financial transactions, fostering accountability among students and staff.

- Control: Allows schools to maintain control over the amounts disbursed to students, ensuring compliance with school policies.

- Convenience: Students can access their pocket money conveniently through the point of sale terminals located on campus.

How SUPA works

SUPA aligns with and capitalizes on the global shift toward cashless economies by providing a modern, secure, and efficient solution for pocket money management, demonstrating its relevance and adaptability in a rapidly digitizing world.

- Integration with Digital Payment Ecosystems:

- SUPA seamlessly integrates with mobile money platforms, bank transfers, and digital wallets, enabling remote replenishment of student pocket money accounts by benefactors.

- E-POS Terminals for Cashless Disbursement:

- The system employs electronic point-of-sale (E-POS) terminals, allowing students to access funds directly without handling physical cash.

- Real-Time Transactions and Monitoring:

- SUPA supports instant fund transfers and transaction notifications, ensuring that users experience the speed and convenience of cashless systems.

- Scalability and Regional Adaptation:

- Designed for boarding schools in Uganda and scalable to the East African region, SUPA adapts to various digital payment infrastructures, supporting the broader cashless economy agenda.

- Secure and Transparent Financial Management:

- With features such as two-factor authentication, spending controls, and detailed transaction records, SUPA ensures secure and accountable management of funds.

- Promoting Financial Literacy in a Cashless Era:

- By familiarizing students with digital funds, SUPA prepares them for active participation in cashless economies, promoting responsible financial habits from an early age.

Why SUPA

By addressing the inefficiencies and risks of traditional cash systems while offering transparency, security, and modern convenience, the SUPA System presents a compelling value proposition for schools, parents, and financial intermediaries alike.

- Modernization and Competitive Edge:

- Positions schools as modern and tech-savvy institutions, appealing to parents seeking secure and convenient solutions.

- Financial intermediaries gain opportunities to expand their services and customer base.

- Cost Savings:

- Reduces the costs associated with handling, transporting, and securing physical cash.

- Automates processes that traditionally required significant administrative overhead, such as cash distribution.

- Convenience and Efficiency:

- Parents and guardians can remotely replenish students’ e-wallet accounts from anywhere using mobile money, bank transfers, or digital wallets.

- Schools avoid the logistical challenges of handling and safeguarding large amounts of physical cash.

- Transactions are processed instantly, reducing delays associated with manual cash handling.

- Promotes Financial Literacy:

- Students learn to manage digital funds responsibly by tracking balances and spending through the system.

- Spending limits and alerts encourage budgeting and mindful financial behavior.

- Enhanced Security:

- Eliminates the risks of theft or loss associated with physical cash.

- Implements secure authentication methods, such as two-factor authentication (2FA), ensuring safe access to funds.

- E-POS terminals provide a secure and traceable mechanism for fund disbursement.

- Financial Transparency and Accountability:

- Benefactors can monitor students’ spending habits and receive detailed transaction reports.

- Schools can track and manage the overall pocket money pool without the risk of mismanagement or fraud.

- The system ensures clear records of every transaction, reducing disputes.

- Regulatory Compliance:

- Ensures adherence to financial regulations, such as anti-money laundering (AML) laws and data protection policies.

- Offers schools and financial intermediaries a compliant framework for managing funds.

- Scalability and Accessibility:

- Easily scalable to accommodate more schools, students, and benefactors.

- Accessible across diverse digital platforms, including mobile apps, web portals, and E-POS terminals.

SUPA BENEFITS MATRIX | |||

The Benefits Matrix provides a clear, comparative view of how the SUPA System meets the distinct needs of each stakeholder, enhancing its value proposition across financial, operational, and developmental dimensions. | |||

| Adopting Institution | Beneficiaries (Students) | Partnering Banks and Financial Intermediaries |

1 | Simplified Cash Management | Financial Literacy | Increased Customer Base |

2 | Transparent Accounting | Secure Access to Funds | Enhanced Revenue Streams |

3 | Enhanced Security | Convenient Transactions | Brand Visibility |

4 | Increased Efficiency | Spending Accountability | Infrastructure Optimization |

5 | Competitive Edge | Empowerment in a Digital Economy | Regulatory Alignment |

Global Perspective

Considering the global perspective in reference to sustainable development goals, SUPA system is strategically aligned to SDG’s 8, 9, 10, and 17 as per the analysis

SDG 8 Decent work and Economic Growth 8.2 Achieve higher levels of economic productivity through diversification, technological upgrading and innovation, including through a focus on high-value added and labour-intensive sectors SUPA integrates digital payment systems, E-POS terminals, and financial institutions, creating employment opportunities and stimulating innovation in financial services. It fosters economic growth by modernizing payment processes and promoting financial inclusion. | |||

SDG 10: Reduced Inequalities 10.2 Promoting universal social, economic and political inclusion. SUPA enhances financial inclusion by providing equitable access to digital financial tools for students, Unbanked and Underbanked Benefactors, regardless of their economic background or geographical location thus bridging the gap between urban and rural schools, SUPA integrates with widely accessible mobile money platforms and digital wallets, allowing individuals without traditional bank accounts to fund students’ pocket money accounts seamlessly. | |||

SDG 17: Partnerships for the Goals 17.16 Enhance the Global Partnership for Sustainable Development SUPA integrates relationships between banking partners, telecommunication companies, and regulatory bodies, to create an innovative, sustainable financial management solution. By leveraging shared expertise, SUPA strengthens financial ecosystems, builds institutional capacity, and scales its impact across Uganda and the East African region, demonstrating how strategic collaborations can drive inclusive digital transformation and support global development goals. | |||

SDG 9: industry, innovation and infrastructure 9.3 increase access to financial services and markets SUPA integrates schools, students, and benefactors in rural and urban areas into the formal financial ecosystem by enabling digital transactions through e-wallets and E-POS terminals, improving access to secure and modern financial services. The SUPA system thus addresses barriers to financial inclusion, by ensuring that even smaller and less-resourced institutions can access cutting-edge financial tools. | |||

School Enrolment Process for the SUPA System

To enroll on the SUPA System, the school is required to follow the steps outlined below:

- Step 1: Complete the Online Enrolment Form

- Visit the SUPA System website and access the digital form for school enrollment.

- Fill out all required information, including the school’s official details, contact information, and the designated representative’s contact information.

- Step 2: Open an Account with the Partner Bank

- Open and maintain an operational account with [Banking Partner], as per the SUPA System requirements.

- Provide necessary documentation for account opening, including the school’s registration certificate and other legal requirements.

- Step 3: Submit Required Documentation

- Submit scanned copies of the following documents:

- School registration certificate.

- Tax identification number (TIN).

- Bank account details for the Partner Bank.

- A signed agreement to adopt the SUPA System.

- Submit scanned copies of the following documents:

- Step 4: Sign the Terms and Conditions Agreement

- Review the SUPA System Terms and Conditions.

- Sign the Agreement acknowledging compliance with all terms, including the opening of the Bank account and payment obligations.

- Step 5: Schedule Onboarding and Training

- Upon successful submission of enrolment details, the school will be contacted by the SUPA System team to schedule onboarding and staff training.

- All relevant school staff (administrators, bursars, etc.) must attend the training to familiarize themselves with the system’s features and functionalities.

- Step 6: System Integration Setup

- Work with the SUPA System team to integrate the school’s internal systems with the SUPA System platform.

- Ensure that the bank account is properly linked for receiving pocket money fund replenishments.

- Step 7: Demo, Test and Go Live

- Conduct a system test to verify the successful setup of the system, ensuring that all functionalities (replenishment, disbursement, accounting) work correctly.

- Once the testing phase is complete and successful, the system will be fully operational, and the school can begin using the SUPA System for student pocket money management.

- Step 8: Start Benefactor Awareness Campaign

- Inform and educate the students’ benefactors (parents or guardians) about the system’s use for replenishing student pocket money.

- Provide details on how to make payments and the process for monitoring their students’ expenses through the system.

- Step 9: Ongoing Support and Monitoring

- After the system is live, the school will have access to ongoing support and monitoring to ensure smooth operation.

- Regular updates and training sessions will be offered as necessary to keep the system up to date.